What Is PIP Insurance?

PIP stands for Personal Injury Protection. It is a type of auto insurance that pays for your medical expenses and a portion of your lost wages after a car accident, regardless of who caused the crash. Because fault doesn’t determine who pays, Florida’s system is called “no-fault” insurance.

Under Florida Statute § 627.736, every vehicle owner in the state is required to carry a minimum of $10,000 in PIP coverage as part of their auto insurance policy. This is not optional. If you own and register a car in Florida, you must have PIP.

The purpose of this system is speed. Rather than waiting months or years for courts to determine who was at fault before you can receive any compensation, PIP ensures you can get medical treatment right away. You file a claim with your own insurance company — not the other driver’s — and your insurer pays your benefits regardless of who caused the accident.

However, there are significant limitations built into this system that catch many accident victims off guard.

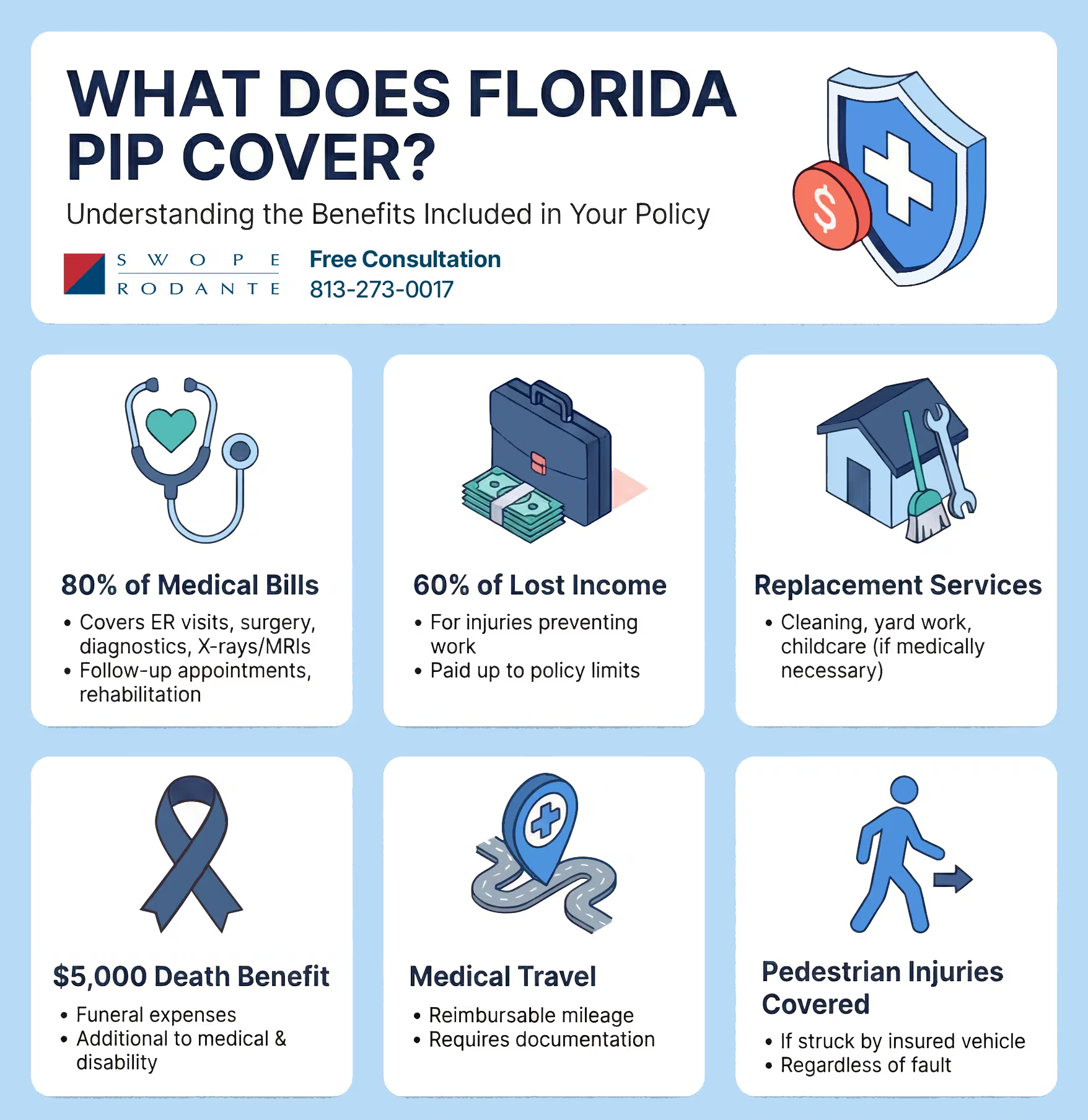

What Does PIP Cover?

Personal Injury Protection coverage in Florida provides benefits in three categories:

80% of Medical expenses. PIP pays 80% of all reasonable and medically necessary expenses related to your accident injuries. This includes emergency room visits, hospital stays, surgeries, doctor’s visits, chiropractic care, physical therapy, X-rays, MRIs, CT scans, prescription medications, dental treatment for accident-related injuries, and rehabilitative services. You are responsible for the remaining 20%, which may be covered by your health insurance or MedPay coverage if you carry it.

60% of Lost wages. If your injuries prevent you from working, PIP pays 60% of your lost income. Your employer will need to submit a wage and salary verification form documenting your earnings in the 13 weeks prior to the accident, and your physician will need to confirm that your injuries prevent you from performing your job duties.

$5,000 of Death benefits. In the tragic event that a car accident results in death, PIP provides a $5,000 benefit for funeral and burial expenses. If you have lost a loved one in a car accident, you may also have grounds for a wrongful death claim that provides significantly greater compensation.

All of these benefits are subject to your policy limit, which is typically $10,000 for standard PIP coverage.

The 14-Day Rule: Florida’s PIP Deadline

Under Florida law, you must seek medical treatment within 14 days of your car accident to qualify for PIP coverage. There are very limited exceptions to this rule. If you wait even one day beyond that 14-day window, your insurer can deny your entire PIP claim. This is where many accident victims unknowingly lose their benefits.

Under Florida law, you must seek medical treatment within 14 days of your car accident to qualify for PIP coverage. There are very limited exceptions to this rule. If you wait even one day beyond that 14-day window, your insurer can deny your entire PIP claim. This is where many accident victims unknowingly lose their benefits.

The 14-day clock starts on the date of the accident, not the date you first notice symptoms. This is critically important because many common car accident injuries — whiplash, soft tissue damage, herniated discs, concussions — may not produce noticeable symptoms for days or even weeks after a crash. The adrenaline and stress of an accident can mask pain, and some injuries develop gradually as inflammation builds.

To satisfy the 14-day rule, your initial treatment must come from one of the following qualified providers:

- A medical doctor (M.D.) licensed under Florida Chapter 458

- A doctor of osteopathic medicine (D.O.) licensed under Florida Chapter 459

- A chiropractic physician licensed under Florida Chapter 460

- A dentist licensed under Florida Chapter 466

- A hospital or hospital-owned facility

- An emergency medical technician or paramedic providing emergency transportation and treatment

A visit to a massage therapist, acupuncturist, or other alternative provider does not satisfy the 14-day requirement, even if that provider later treats your injuries.

The bottom line: If you’ve been in a car accident in Florida, see a doctor as soon as possible, even if you feel fine. Our guide on what to do after a car accident in Florida explains the full process, but the single most important step is getting medical attention within the 14-day window.

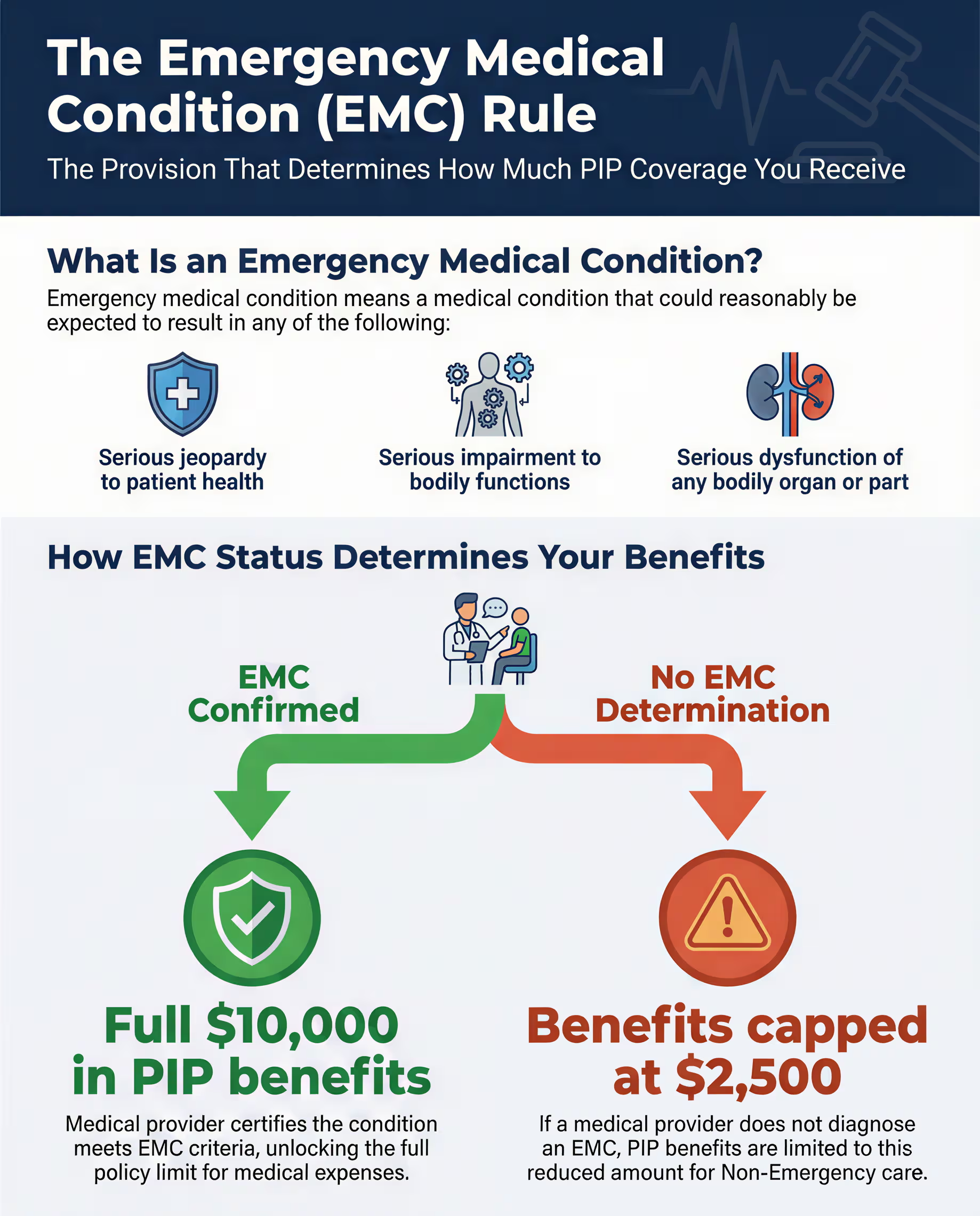

The Emergency Medical Condition (EMC) Rule

The 14-day rule is not the only hurdle. There is a second, lesser-known provision that determines how much PIP coverage you actually receive.

The 14-day rule is not the only hurdle. There is a second, lesser-known provision that determines how much PIP coverage you actually receive.

Under the 2012 amendments to the PIP statute, your benefits depend on whether a physician determines that you have an “emergency medical condition” (EMC). Florida Statute § 627.732 defines an EMC as a condition with acute symptoms severe enough that the absence of immediate medical attention could reasonably be expected to result in:

- Serious jeopardy to patient health

- Serious impairment to bodily functions

- Serious dysfunction of any bodily organ or part

If a qualified physician determines that you have an EMC, you are entitled to the full $10,000 in PIP benefits. If your condition does not qualify as an emergency, your benefits are capped at $2,500 — a fraction of what most accident injuries cost to treat.

This distinction matters enormously. A $2,500 cap may barely cover an emergency room visit and a single follow-up appointment. For accident victims with injuries requiring ongoing treatment, the difference between $2,500 and $10,000 can mean the difference between receiving adequate care and being left with mounting medical bills.

An EMC determination can be made by emergency room physicians, your treating doctor, or in some cases through telemedicine evaluations. The determination does not need to happen at the time of treatment, but the longer you wait, the harder it becomes to establish that your injuries warranted emergency-level concern.

What PIP Does Not Cover

Understanding PIP’s limitations is just as important as understanding its benefits. PIP does not cover:

Pain and suffering. PIP is strictly limited to economic damages — medical bills and lost wages. It provides zero compensation for physical pain, emotional distress, mental anguish, loss of enjoyment of life, or any other non-economic harm you’ve suffered.

The full cost of your medical bills. Even with an EMC determination, PIP only covers 80% of your expenses up to $10,000. If your medical bills total $12,000, PIP pays $8,000 (80% of the $10,000 limit), and you are responsible for the remaining $4,000.

The full amount of your lost wages. PIP covers only 60% of your income loss, leaving you short 40% of every paycheck you miss.

Property damage. PIP is a personal injury benefit. Damage to your vehicle is covered separately under your Property Damage Liability (PDL) coverage or the at-fault driver’s insurance.

Injuries exceeding the policy limit. For serious accidents involving traumatic brain injuries, spinal cord damage, or burn injuries, $10,000 is nowhere near enough. A single ambulance ride, ER visit, and MRI can easily exceed that amount before you’ve even begun a course of treatment.

When Can You Sue the At-Fault Driver in Florida?

Florida’s no-fault system does not mean you can never sue the person who caused your accident. It means you must first go through your own PIP insurance, and you can only step outside the no-fault system if your injuries meet a specific legal standard.

Under Florida Statute § 627.737, you may file a personal injury lawsuit against the at-fault driver if your injuries consist of one or more of the following:

Significant and permanent loss of an important bodily function. This includes injuries such as loss of vision, hearing, organ function, limb mobility, or reproductive capacity — any impairment that meaningfully and permanently diminishes your ability to function.

Permanent injury within a reasonable degree of medical probability. This covers injuries that a physician can confirm, to a reasonable medical certainty, will not fully heal. Herniated discs, torn ligaments requiring surgery, chronic nerve damage, and traumatic brain injuries often qualify.

Significant and permanent scarring or disfigurement. Severe burns, visible surgical scars, facial disfigurement, or amputations that substantially alter your physical appearance.

Death. Wrongful death claims are automatically exempt from the no-fault threshold.

If your injuries meet any one of these criteria, you gain the right to pursue a full personal injury lawsuit against the negligent driver. This opens the door to compensation for pain and suffering, emotional distress, loss of enjoyment of life, full (not partial) medical expenses, full lost wages, and future damages — categories of compensation that PIP simply does not provide.

Insurance companies and defense attorneys routinely challenge whether injuries meet the serious injury threshold, particularly in cases involving soft tissue damage and disc injuries. Thorough medical documentation from the outset of your treatment is essential.

PIP and Other Types of Insurance Coverage

PIP is just one piece of the auto insurance puzzle in Florida. Understanding how it interacts with other coverages can significantly affect your recovery.

Property Damage Liability (PDL). Florida requires a minimum of $10,000 in PDL coverage. This pays for damage you cause to someone else’s property — not your own vehicle. PDL and PIP are the only two coverages Florida law requires.

Bodily Injury Liability (BIL). This coverage pays for injuries you cause to others in an accident. Florida does not require BIL coverage, and roughly half of all Florida drivers do not carry it. This creates a serious problem when you are injured by an at-fault driver who has no BIL coverage — there may be no insurance available to compensate you beyond your own PIP benefits.

Uninsured/Underinsured Motorist Coverage (UM/UIM). This is arguably the most important optional coverage a Florida driver can purchase. UM coverage protects you when the at-fault driver has no bodily injury insurance or insufficient coverage to pay for your injuries. Given that so many Florida drivers lack BIL coverage, UM insurance fills a critical gap. Under Florida Statute § 627.727, if you have UM coverage on multiple vehicles on your policy, you may be able to “stack” those coverages for higher limits.

Medical Payments Coverage (MedPay). MedPay is an optional add-on that covers the 20% of medical expenses PIP does not pay. It can also help cover your PIP deductible. MedPay is relatively inexpensive and can prevent you from being stuck with thousands of dollars in out-of-pocket costs after an accident.

Collision Coverage. If you are at fault in an accident or the other driver has no insurance, collision coverage pays for damage to your own vehicle, minus your deductible.

Common Mistakes That Cost Florida Accident Victims Their PIP Benefits

These are the errors we see most frequently — and they can be devastating to your claim:

Waiting too long to see a doctor. The 14-day rule is absolute. Even a 15th-day visit to the emergency room will not qualify. Do not wait for symptoms to appear before seeking treatment.

Accepting an early settlement from your insurance company. Insurers often send settlement offers before you know the full extent of your injuries. Once you accept, you cannot reopen the claim or seek additional compensation, even if your condition worsens significantly.

Not following through on treatment. Gaps in your medical treatment give insurers ammunition to argue that your injuries are not serious or that they were not caused by the accident. Attend every scheduled appointment, fill your prescriptions, and follow your doctor’s treatment plan.

Giving a recorded statement without legal guidance. Insurance adjusters often contact accident victims within hours of a crash, asking for a recorded statement about what happened. What you say can be used to reduce or deny your benefits. You are not legally required to give a recorded statement, and doing so without understanding the implications can be harmful to your claim. Learn more about how insurance companies act in bad faith.

Not understanding the EMC distinction. If your doctor does not determine that your injuries constitute an emergency medical condition, your benefits are capped at $2,500 regardless of how much treatment you need. Make sure your physician understands the significance of this determination.

Assuming PIP is enough. For any accident involving more than minor injuries, $10,000 in PIP coverage is insufficient. Understanding your right to pursue additional compensation through a personal injury claim is essential to a full recovery.

How to File a PIP Claim in Florida

The process for filing a PIP claim is straightforward, but the details matter:

- Report the accident to your insurance company as soon as possible. Florida law requires prompt notification. Ask for your claim number and the contact information for your claims adjuster.

- Seek medical treatment within 14 days. Visit a qualified medical provider — an M.D., D.O., hospital, or emergency medical provider. Make sure they document that your injuries are related to the accident.

- Provide your medical providers with your PIP information. Give them your claim number, adjuster’s name, and claims office contact information. Authorize them to bill your PIP coverage directly.

- Submit a wage verification form if you’re missing work. Your employer must complete this form to document your pre-accident earnings.

- Keep detailed records of everything. Save all medical bills, receipts, correspondence with your insurer, and notes about how your injuries affect your daily life.

Your insurer is required by law to pay PIP benefits within 30 days of receiving written notice of the covered loss. The insurer may take an additional 60 days to investigate if there is a suspicion of fraud, but payment must still be made within the initial 30-day window.

If your insurer delays, underpays, or denies your PIP claim, Florida law provides remedies including the right to file a demand letter and, if necessary, pursue legal action to recover your benefits. Learn more about your options when the at-fault driver’s insurance won’t pay or when insurers engage in bad faith practices.

When You Need an Attorney for a PIP Claim

Not every PIP claim requires an attorney. If your injuries are minor, your treatment is complete, and your insurer pays promptly, you may be able to handle the claim on your own.

However, there are situations where legal representation becomes essential:

- Your injuries are serious and your medical bills exceed or will exceed the $10,000 PIP limit

- Your insurer is delaying payment, underpaying, or denying your claim

- You meet the serious injury threshold and may be entitled to sue the at-fault driver

- The at-fault driver has no bodily injury liability coverage

- You are being contacted by the other driver’s insurance company and asked for a statement

- Your EMC determination is being disputed

- You are unsure whether to accept a settlement offer

An experienced Tampa car accident lawyer can evaluate whether your injuries qualify for compensation beyond PIP, negotiate with insurance companies on your behalf, and ensure that you do not forfeit benefits through procedural mistakes or missed deadlines. Here are some questions to ask before hiring a car accident lawyer.

Frequently Asked Questions About Florida PIP Insurance

Does PIP cover passengers in my car? Yes. PIP extends to passengers in the insured vehicle at the time of the accident, as well as relatives residing in the policyholder’s household. It also covers pedestrians and cyclists struck by the insured vehicle.

Will my insurance rates go up if I file a PIP claim and the accident wasn’t my fault? Under Florida law, your premiums should not increase if you were not at fault. PIP premiums are calculated based on statewide risk factors, not individual fault determinations.

What if the other driver doesn’t have insurance? If the at-fault driver has no bodily injury liability coverage — and roughly half of Florida drivers do not — your PIP will still cover your initial medical expenses and lost wages up to the policy limit. Beyond that, your uninsured motorist (UM) coverage, if you carry it, becomes your most important protection. Learn more about Florida’s insurance requirements.

Can I use my health insurance alongside PIP? Yes, but PIP is considered primary coverage — it pays first. Your health insurance may cover expenses that exceed your PIP limits or the 20% that PIP does not pay. However, some health insurance policies require proof that PIP benefits have been exhausted before they begin paying.

What if my PIP claim is denied? If your claim is denied, you have the right to request a written explanation, dispute the denial, and if necessary, file a demand letter under Florida Statute § 627.736. If the insurer does not respond appropriately, you may be entitled to pursue legal action, including recovery of attorney’s fees.

Contact Swope, Rodante P.A.

Navigating Florida’s no-fault insurance system after a serious accident is complicated — and insurance companies are not on your side. At Swope, Rodante P.A., we have spent decades helping Florida accident victims understand their rights, maximize their PIP benefits, and pursue full compensation when their injuries warrant it.

If you’ve been in a car accident in Florida and have questions about your PIP coverage, the 14-day rule, or whether you may be entitled to additional compensation, contact us for a free case evaluation. We work on a contingency fee basis, which means you pay nothing unless we recover compensation for you.