40 Years of Experience Winning Bad Faith Insurance Cases in Florida

At Swope, Rodante P.A., we fight for justice. With over 40 years of experience, our dedicated team specializes in winning cases against insurance companies in Florida..

Insurance carriers denying valid claims cause real harm to families and businesses in Tampa, Florida.

We are passionate advocates dedicated to protecting our clients from insurance carriers that neglect their duty to settle cases when they reasonably could have and should have. We understand the unnecessary stress this adds to an already challenging situation. Our approach involves listening carefully to individuals who believe they are victims of insurance bad faith, ensuring they fully comprehend their available options

Call (813) 273-0017 for a free consultation with our Tampa insurance bad faith lawyers. Our expert legal team is here to help.

Florida-Wide Advocacy: Your Trusted Partner for Insurance Bad Faith Representation

Swope, Rodante P.A., is headquartered in Tampa, but our reach extends far beyond city limits. With a proven track record, our dedicated team of attorneys serves clients from the southern tip of Florida, including vibrant cities like Miami and Fort Lauderdale, all the way up through the central part of the state, encompassing areas like Orlando, Tampa, and Sarasota. Our commitment to justice knows no bounds, as we also advocate for clients in North Florida and the Panhandle, covering regions such as Jacksonville, Tallahassee, and Pensacola. When it comes to insurance bad faith, we’re not confined by geography. Whether you’re in South Florida, Central Florida, or anywhere else in the Sunshine State, our experienced team is here to protect your rights.

Choosing the right law firm to represent you in an insurance bad faith case significantly impacts the outcome of your case. That’s why we’re proud to share some of our third-party recognitions and accolades, which underscore our unwavering commitment to excellence. When you work with us, you’re not just hiring attorneys; you’re partnering with a team that has been vetted, celebrated, and proven. Here are a few reasons why we stand out:

National Recognition

- Super Lawyers: Our attorneys have been recognized by Super Lawyers Magazine, a prestigious honor bestowed upon the top legal professionals. In 2023, Dale Swope, Brent Steinberg, Daniel Greene, and Sean Shaw were acknowledged for their exceptional work.

- AV Rated by Martindale-Hubbell: Partners Dale Swope, Angela Rodante, Brent Steinberg, Daniel Greene, and Attorney Anna Frederiksen all hold this prestigious rating, signifying their legal excellence.

- Best Lawyers & U.S. News “Best Law Firms”: We’ve consistently received this recognition since 2010, a testament to our commitment to excellence.

Expertise and Leadership

- President of the Florida Justice Association: In 2017-18, Dale Swope led this influential organization, advocating for justice and fairness.

- Member of the American College of Coverage Counsel: Since 2019 Angela Rodante has been a fellow in recognition as one of the most prominent members of the insurance law bar.

- Board Certified in Civil Trial Law: Dale Swope has held this distinction from The Florida Bar since 1992 to present, demonstrating his mastery in civil trial matters.

- Board Certified in Appellate Practice: Brent Steinberg has held this distinction from The Florida Bar since 2022 to present, demonstrating his mastery in civil trial matters.

In addition to the accomplishments specified above Swope, Rodante P.A. and our lawyers are members of or have been recognized by dozens of other organizations including the Tampa Bay Trial Lawyers Association, Florida Trend, National Trial Lawyers, American Board of Trial Advocates, and many more. When you choose Swope, Rodante P.A., you’re not just hiring attorneys; you’re gaining a trusted partner with a proven track record.

What is Insurance Bad Faith?

Insurance bad faith is when an insurance company:

- Unreasonably stalls on making a decision on a claim.

- Denies a claim that it knows is legitimate.

- Requires unreasonable actions or documentation by the insured.

- Fails to settle a claim within its policy limits when it should have done so had it acted fairly and honestly toward its insured and with due regard for his or her interests.

Large insurance companies have significant power, money and resources at their disposal which can be intimidating.

But, our insurance bad faith attorneys specialize in handling “David and Goliath” type cases. We are proud to champion the underdog and battle against the toughest opponents.

When attorneys at other law firms need to call a bad faith lawyer in Florida, they think of Swope, Rodante P.A.

Below are some of the most common questions we are asked regarding insurance bad faith:

What Does the Term Insurance Bad Faith or Bad Faith Insurance Mean?

Bad faith is a cause of action that is brought against an insurer for breaching its duty to act in good faith toward its insured in settlement of a claim.

In Florida, the term ‘insurance bad faith’ or ‘bad faith insurance’ refers to the unethical or dishonest conduct of an insurance company in handling an insurance claim.

When individuals or businesses enter into an insurance contract, they place their trust in the insurer to act in good faith.

This means that the insurer is expected to fairly and promptly process claims, provide a thorough investigation, and make timely payments for valid claims.

However, bad faith can occur when an insurance company unreasonably denies, delays, undervalues, or mishandles a claim without a reasonable basis.

In Florida, insurance companies are required to adhere to specific laws and regulations governing fair claim handling practices.

The concept of insurance bad faith is crucial for policyholders in Florida because it provides a legal recourse when they believe an insurance company has acted dishonestly or unfairly.

Policyholders who encounter bad faith practices may have the right to pursue legal action against the insurer to seek compensation for damages, including economic losses and even punitive damages.

It’s important for individuals and businesses in Florida to be aware of their rights and the signs of bad faith, such as unjustified claim denials, unreasonable delays, insufficient communication, and coercive settlement tactics.

Consulting with an experienced insurance attorney in Florida can provide guidance and assistance in navigating the complexities of insurance bad faith cases, protecting the policyholders’ rights and pursuing fair compensation.

By understanding the meaning of insurance bad faith in Florida, policyholders can take appropriate action to address any unjust treatment from insurance companies and ensure that their rights are protected throughout the claims process.

What Are My Rights Under My Insurance Policy?

An insurance policy is a contract. Basically, if you’re abiding by your end of the contract – paying premiums on time – then the insurer has a good-faith duty to abide by the conditions in the policy that require them to pay out benefits in the event of an accident.

When it comes to an insurance bad faith claim in Florida, it’s essential to understand all of your rights under your insurance policy. As a policyholder, your rights may include:

- Right to Prompt and Fair Claim Handling: Insurance companies in Florida are obligated to handle claims promptly and in good faith. This means they should conduct a thorough investigation, communicate with you in a timely manner, and fairly evaluate your claim based on the terms and conditions of your policy.

- Right to a Clear Explanation: If your insurance claim is denied or undervalued, you have the right to receive a clear and reasonable explanation from your insurance company. They should provide specific details regarding the basis for their decision, citing any policy provisions or applicable laws.

- Right to Challenge Claim Denials: If you believe your claim has been wrongfully denied or undervalued, you have the right to challenge the decision. In Florida, you can seek legal remedies to contest the denial, such as filing a lawsuit against the insurance company for breach of contract or bad faith.

- Right to Compensation: In the event that your insurance company has acted in bad faith, you may be entitled to compensation beyond the initial coverage. This can include economic damages, such as the full value of your claim, as well as potential punitive damages meant to punish the insurer for their wrongful conduct.

- Right to Legal Representation: Throughout the insurance claim process, you have the right to seek legal representation. Hiring an experienced insurance attorney in Florida can provide valuable guidance, protect your rights, and help you navigate the complexities of a bad faith claim.

Does an Insurer Have the Right to Deny My Claim?

Insurers may have the right to deny claims in some situations where the policyholder has not fulfilled the terms of his or her insurance contract such as failing to make monthly payments or in situations where the claim is not covered by the policy or is fraudulent.

In the unfortunate event that your insurance claim has been denied, it’s important to be able to identify whether the denial was fair or if it may be an example of insurance bad faith.

In Florida, policyholders have certain rights and protections. Here are some key factors to consider when determining if your claim has been unfairly denied:

- Review Your Policy: Carefully examine your insurance policy to understand the coverage, exclusions, and conditions that apply to your specific claim. Familiarize yourself with the provisions relevant to your situation, as they form the basis for evaluating the fairness of the denial.

- Seek Clarification: If your claim has been denied, request a detailed explanation from your insurance company. They should provide clear reasons for the denial, citing specific policy language or applicable laws. Pay attention to the adequacy and specificity of their response.

- Evaluate the Claim Handling Process: Assess the handling of your claim by the insurance company. Consider factors such as the timeliness of their responses, the extent of their investigation, and the reasonableness of their requests for additional information. Look for any signs of undue delay, lack of communication, or failure to conduct a thorough evaluation.

- Compare with Similar Cases: Research similar cases and precedents to gauge the industry standards and the treatment of claims similar to yours. This can help determine if your denial aligns with common practices or if it deviates significantly, potentially indicating bad faith.

- Document Evidence: Keep a record of all communication and documentation related to your claim. This includes correspondence with the insurance company, claim forms, receipts, photographs, and any other supporting evidence. Having a comprehensive record can strengthen your position if you decide to challenge the denial.

- Consult State Regulations: Familiarize yourself with Florida’s insurance regulations and consumer protection laws. The Florida Office of Insurance Regulation provides valuable resources that outline the rights of policyholders and the obligations of insurance companies.

Remember, determining if your claim has been unfairly denied can be complex. Each case is unique, and the specifics of your situation may require legal expertise to fully evaluate.

Seeking guidance from our experienced insurance attorneys can help you navigate the complexities of insurance bad faith claims and assert your rights as a policyholder in Florida.”

What Should I Do if an Insurance Company Denied My Claim Without Providing a Reason?

If an insurer denies a claim without providing a reason, it can be frustrating and concerning. In such a situation, there are several steps a consumer can take to address the issue effectively:

- Review the Policy: Carefully read through your insurance policy to ensure that the claim you filed is within the covered scope. Understand the terms, conditions, and exclusions of the policy to determine if the denial is valid or if there has been an error or oversight.

- Contact the Insurance Company: Reach out to the insurance company’s claims department or customer service to inquire about the reason for the denial. Politely request a clear and detailed explanation for the denial. Document the date, time, and the person you spoke with during the conversation.

- Follow up in Writing: If the initial contact with the insurance company does not provide a satisfactory explanation, send a written request for a detailed explanation of the denial. Keep a copy of the letter or email for your records. Be sure to include your policy number, claim number, and any relevant supporting documents.

- Document Everything: Maintain a record of all correspondence and interactions with the insurance company. This includes phone calls, emails, letters, and any other forms of communication. Keep copies of any documents you submitted as part of the claim.

- Seek Legal Advice: If the insurance company continues to deny your claim without providing a reasonable explanation, it may be necessary to consult with an experienced insurance attorney. They can evaluate your case, review the policy, and advise you on the best course of action to challenge the denial.

- File a Complaint: If all attempts to resolve the issue directly with the insurance company prove unsuccessful, you can consider filing a complaint with the relevant regulatory authorities. In Florida, you can contact the Florida Office of Insurance Regulation to report the denial and seek assistance.

- Explore Alternative Dispute Resolution: Depending on the circumstances, alternative dispute resolution methods such as mediation or arbitration may be viable options to resolve the claim dispute without resorting to litigation. An attorney can guide you through these processes.

Remember, each case is unique, and the appropriate course of action may vary. Seeking legal advice is crucial to understand your rights, determine the validity of the denial, and explore potential legal remedies available to you as a consumer.

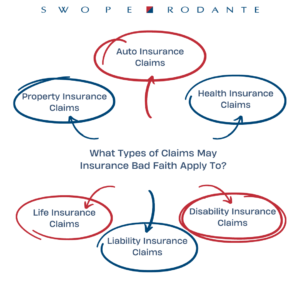

What Types of Insurance Claims Can Insurance Bad Faith Apply To?

Insurance bad faith occurs when an insurance company fails to fulfill its obligations to policyholders.

In Florida, insurance bad faith can apply to most types of insurance claims, including:

- Property Insurance Claims: Insurance bad faith can occur in property insurance claims, such as those related to damage caused by natural disasters, fires, or other covered events. If an insurance company unreasonably denies, undervalues, or delays payment for a valid property damage claim, it may be considered bad faith.

- Auto Insurance Claims: Auto insurance claims are also susceptible to insurance bad faith. This can include unjustified claim denials, unreasonable delays in processing claims, or failure to properly investigate accidents or assess damages.

- Health Insurance Claims: Health insurance policies can involve complex claim processes. Insurance bad faith in health insurance may include unjustified denial of medical treatments, improper delays in approving necessary procedures, or unfair termination of coverage without proper explanation.

- Life Insurance Claims: Life insurance policies are designed to provide financial security to beneficiaries upon the policyholder’s death. Insurance bad faith can occur if an insurer unreasonably denies or delays payment of a valid life insurance claim, fails to thoroughly investigate the claim, or disputes the policy’s validity without a reasonable basis.

- Disability Insurance Claims: Disability insurance is meant to provide income replacement if an individual becomes disabled and unable to work. Insurance bad faith can arise if an insurer unreasonably denies or delays payment of a valid disability claim, fails to conduct a proper evaluation, or improperly terminates benefits.

- Liability Insurance Claims: Insurance bad faith can apply to liability insurance claims as well. This may include situations where an insurer refuses to defend or settle a claim against its policyholder without a reasonable basis or fails to communicate effectively with the insured during the claims process.

If you have a question about whether insurance bad faith applies to your claim, please contact us.

What Are Some Common Examples of Bad Faith?

Insurance bad faith refers to the unethical or dishonest conduct of an insurance company towards policyholders.

Here are common examples of insurance bad faith that policyholders should be aware:

- Unreasonable Claim Denial: One of the most prevalent examples of bad faith is when an insurance company unjustifiably denies a valid claim. This can occur when the insurer fails to provide a reasonable explanation, misinterprets policy terms, or applies arbitrary exclusions to avoid payment.

- Delayed Claims Processing: Insurance companies are expected to handle claims promptly and efficiently. Unreasonable delays in processing a claim without valid justification can be considered bad faith. Delays can cause financial hardships for policyholders who rely on insurance benefits to cover their losses.

- Inadequate Investigation: Insurers have a duty to conduct a thorough investigation when evaluating claims. If an insurance company fails to investigate a claim adequately or ignores vital evidence, it may be acting in bad faith.

- Lowball Settlement Offers: When an insurance company intentionally undervalues a claim and offers an unreasonably low settlement amount, it is an example of bad faith. Insurers have an obligation to fairly evaluate the value of the claim based on the policy’s coverage and the actual damages suffered.

- Lack of Communication: Effective communication is essential throughout the claims process. Insurance companies that fail to provide clear and timely updates, ignore policyholders’ inquiries, or avoid responding to legitimate concerns are exhibiting bad faith behavior.

- Breach of Duty to Defend: In liability insurance, the insurer has a duty to defend the insured against claims. If an insurance company refuses to defend the policyholder in a covered claim without a valid reason, it can be considered bad faith.

- Misrepresentation or Fraud: Intentional misrepresentation or fraud by an insurance company, such as providing false information, forging documents, or misrepresenting policy terms, is a severe example of bad faith.

It’s important for policyholders to recognize these common examples of bad faith. If you believe your insurance company has acted in bad faith, consult with an experienced insurance attorney.

They can evaluate your situation, determine if bad faith exists, and guide you through the process of asserting your rights and seeking appropriate legal remedies.

How Do I Sue My Insurance Company for Bad Faith in Tampa, or Florida?

Insurance bad faith laws in Florida are complex therefore it is advised consumers who feel like they may have a claim should call our firm to discuss their options.

If you are considering suing your insurance company for bad faith, follow these steps:

- Understand Florida’s bad faith laws: In Florida, bad faith claims against insurance companies are governed by Florida Statutes Sections 624.155 and 626.9541. Familiarize yourself with these laws to understand the duties and responsibilities of insurance companies and the potential remedies available to policyholders in cases of bad faith.

- Document the evidence: Gather all relevant documents related to your insurance policy, claim, and interactions with the insurance company. This includes policy documents, claim forms, correspondence, photographs, medical records, and any other evidence that supports your case. Strong documentation is essential in proving your claim of bad faith.

- Consult an attorney: Seek the advice of an experienced insurance law attorney in Tampa, Florida. They will assess your case, help you understand your rights under Florida law, and guide you through the legal process. An attorney familiar with Tampa and Florida-specific laws can provide you with the most accurate and relevant advice for your situation.

- Provide notice to the insurance company: In Florida, before filing a bad faith lawsuit, you typically need to provide a written notice to the insurance company. This notice should detail the specifics of your claim and give the insurance company an opportunity to resolve the matter. The insurance company then has a limited time to respond to the notice.

- Mediation or appraisal: In some cases, Florida law may require you to participate in mediation or appraisal before filing a lawsuit. Mediation involves a neutral third party helping to facilitate a resolution between you and the insurance company. Appraisal involves an impartial evaluation of the value of your claim. Consult with your attorney to determine if these steps are necessary in your case.

- Filing a lawsuit: If the insurance company fails to resolve the matter or if mediation/appraisal does not lead to a satisfactory outcome, your attorney can help you file a lawsuit in the appropriate Tampa, Florida state court. The lawsuit will outline the basis of your bad faith claim, the damages you seek, and the alleged acts of bad faith by the insurance company.

- Building your case: Collaborate closely with your attorney to build a strong case. This involves gathering additional evidence, identifying relevant witnesses, and preparing compelling legal arguments that demonstrate the insurance company’s bad faith conduct.

- Settlement or trial: Throughout the legal process, there may be opportunities for settlement negotiations with the insurance company. If a settlement cannot be reached, the case may proceed to trial, where both parties present their arguments and evidence to a judge or jury.

Insurance Bad Faith Case Study

Introduction

The insurance bad faith attorneys at Swope, Rodante P.A. specialize in holding insurance companies accountable when their actions, or lack of action, result in excess verdicts against policyholders. While every case is unique, it can be beneficial to break down an individual case to understand how similar cases may be approached.

Problem

In 2009, when Ishmael was a minor, he was involved in a collision while on his way to school. The woman he hit suffered a lower back injury and was awarded over $400,000 in a personal injury lawsuit. The judgment against Ishmael and his family threatened their financial future.

Solution

After hiring Swope, Rodante P.A., the firm informed Ishmael that the insurance company had an opportunity to settle the claim against him for the policy limits. It appeared that the insurance company had acted in bad faith by failing to settle the claim at that time.

Implementation

The bad faith attorneys representing Ishmael then thoroughly reviewed all the documents associated with the case. This included communications between the insurance company and the attorney who sued Ishmael, communications from the insurance company and defense counsel with Ishmael, and even the claims file itself. During the discovery process, the attorneys at Swope, Rodante P.A. deposed key figures in the case and ultimately constructed a timeline establishing what the carrier knew and when they should have tendered the policy limits. It was shown that the insurance carrier could have and should have settled the case if they had shown due regard for their insured.

Results

Despite the strong evidence against them, the insurance company again refused to settle the claim. Swope, Rodante’s bad faith attorneys went to court on behalf of Ishmael, and the jury found in favor of Ishmael. Eventually, the insurance company paid the judgment to the woman who was originally injured by Ishmael, and the judgment against him was satisfied.

Testimonial

“After we heard the verdict and found out that we were absolved of almost a $400,000 debt, I knew we had made the right choice in choosing the attorneys that we did. They are literally my heroes. I don’t know any better people who would have done us justice. To me, heroes are people who give you a voice and defend the small people that don’t have a voice. They definitely gave us a voice and stood up for us. I am so grateful for what they did for us. They are and always will be a part of my family.”

Conclusion

While the entire process, from the underlying case to the bad faith trial, was unpleasant, Ishmael and his family were eventually relieved of a devastating judgment against them. The bad faith attorneys at Swope, Rodante P.A. in Tampa, Florida proved to a jury that the insurance carrier had acted in bad faith, and it is the carrier, not Ishmael or his family, that should be responsible for the judgment.

For more information about this insurance bad faith case study, watch this client testimonial video:

While some law firms shy away from cases against large insurance companies, we specialize in them.

We are proud to represent the underdog and stand firm behind our mission to help those who have been the victims of insurance bad faith.

Call (813) 273-0017 for a free consultation with a Tampa bad faith insurance lawyer. We’ll answer your questions and help you understand your rights as a policyholder.

The information here was last updated January 24, 2024.